Secure your health with comprehensive insurance plans from Nivabupa

Tell us a bit about you

What is Pradhan Mantri Jeevan Jyoti Bima Yojana Age Limit?

Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY) is a life insurance scheme introduced by the Government of India. Launched in 2015, this scheme aims to provide affordable and accessible life insurance coverage to individuals across the country. It offers financial security and peace of mind to policyholders and their families in case of unfortunate events.

While the scheme has garnered widespread attention, one important aspect to consider is the PMJJBY age limit for enrolment. This blog will discuss the same.

PMJJBY Age Limit

The government has set a specific age limit for individuals who wish to enrol in the scheme. Individuals between the age of 18 and 50 years are entitled to join this scheme. It is important to note that though individuals outside this age bracket cannot join the scheme, benefits can be availed up to 55 years of age if enrolled before 50.

The age limit plays a crucial role in determining eligibility for PMJJBY. By setting the age range between 18 and 50 years, the scheme aims to cover a wide demographic of individuals who are typically the primary breadwinners or earners in their families. This age bracket represents a significant segment of the population that can benefit from affordable life insurance coverage.

Enrolment Process

Other than meeting the PMJJBY age limit, individuals must also have a bank account or a post office savings account to be eligible for the scheme. Such individuals can approach any participating bank or insurance company to apply. Even NRIs holding a bank account with a branch located in India can avail the cover.

The application process usually involves filling out a simple form and providing the necessary documents, such as age proof and an Aadhaar card. The application form can also be accessed from the Jan Suraksha website.

Once enroled, policyholders need to ensure that the premium amount is maintained in their bank account to continue availing the benefits of the scheme. The auto-debit facility can be availed for increased convenience. A waiting period of 30 days is applicable, during which no claim is admissible for death (other than due to accident). If individuals exit the scheme, they can also rejoin in future years.

Insurance Coverage and Benefits

Under this scheme, policyholders are provided with a life insurance cover of ₹2 lahks (200,000 rupees) in the event of the insured person's death. The coverage extends for one year, and policyholders have the option to renew their policy annually. The premium for this scheme is set at an affordable rate, i.e., ₹436 per annum, making it accessible to a large section of the population.

The scheme is open for enrolment from 1st June to 31st May. For the first year, individuals can join the scheme in the middle of the policy year. Pro-rata premium payments are allowed in this case, which is appropriated as follows:

Particulars |

Enroled in June, July and August |

Enroled in September, October, and November

|

Enroled in December, January and February |

Enroled in March, April and May |

Premium Payable |

₹436 |

₹342 |

₹228 |

₹114 |

Premium appropriated to insurance company

|

₹395 |

₹309 |

₹206 |

₹103 |

Amount appropriated for commissions |

₹30 |

₹22.50 |

₹15 |

₹7.50

|

Administrative expenses for participating banks

|

₹11 |

₹10.50 |

₹7 |

₹3.50

|

To Sum Up

Pradhan Mantri Jeevan Jyoti Bima Yojana has emerged as a significant initiative by the Indian government to provide life insurance coverage to individuals across the nation. While the scheme aims to offer financial security to a wide range of individuals, it has an age limit of 18 to 50 years.

It is important to note that the PMJJBY age limit may undergo changes over time. Therefore, it is advisable to refer to the latest information from official sources like the Jan Suraksha website to obtain the most accurate and up-to-date details regarding the PMJJBY age limit and other requirements.

In addition, if you don’t meet the PMJJBY age limit or want more comprehensive insurance coverage, you can select plans from private insurers like Niva Bupa. From individual plans, best health insurance for senior citizens, family plans, and corporate plans to travel insurance and critical illness insurance- Niva Bupa offers a variety of plans for every need. Check out our plans and gain access to 10,000+ network hospitals and a smooth 30-minute claim processing facility.

Secure your health with comprehensive insurance plans from Nivabupa

Tell us a bit about you

The Niva Bupa Customer Login Portal is a secure online platform that allows Niva Bupa customers to access their health insurance policies and manage their accounts.

READ MORE

Cashless hospitals provide a multitude of benefits, offering a seamless and convenient healthcare experience. Read to know more.

READ MORE

Niva Bupa policy Renewal- Renewing health insurance policy is very important if you want to have a continue protection against medical emergency. Follow Steps for Niva Bupa Policy Renewal process.

READ MORE

Gurgaon has more than 100 private and government hospitals, with the best staff, technology, services, etc. In the article, Niva Bupa has listed top 10 hospital in gurgaon like Fortis, Medanta, etc. Get to know more.

READ MORE

Learn about ABHA Card and Ayushman Card and understand the major difference between the two.

READ MORE

Niva Bupa has taken significant steps to support its customers during the COVID-19 pandemic, including implementing changes to its claims process and making it easier to access telemedicine services.

READ MORE

Renewing your insurance policy ensures uninterrupted coverage and protects you against unforeseen expenses.

READ MORE

Niva Bupa explains the difference between private healthcare & public healthcare in India. Read the article and know about the details & the difference between the two.

READ MORE

If you are facing kidney issues, there are many kidney hospitals in India where you can get the best treatment. These hospitals have the best nephrologists in India with a great experience. This article has listed the top 5 kidney hospitals in India. Read the article to know more.

READ MORE

Read to know the diseases covered by Ayushman Bharat diseases list which covers a wide range of medical procedures and treatments that cater to different diseases.

READ MORE

Pre & Post Hospitalization Expenses play an important role in a health insurance cover. In the article, Niva Bupa has explained what are pre & post hospitalization expenses.

READ MORE

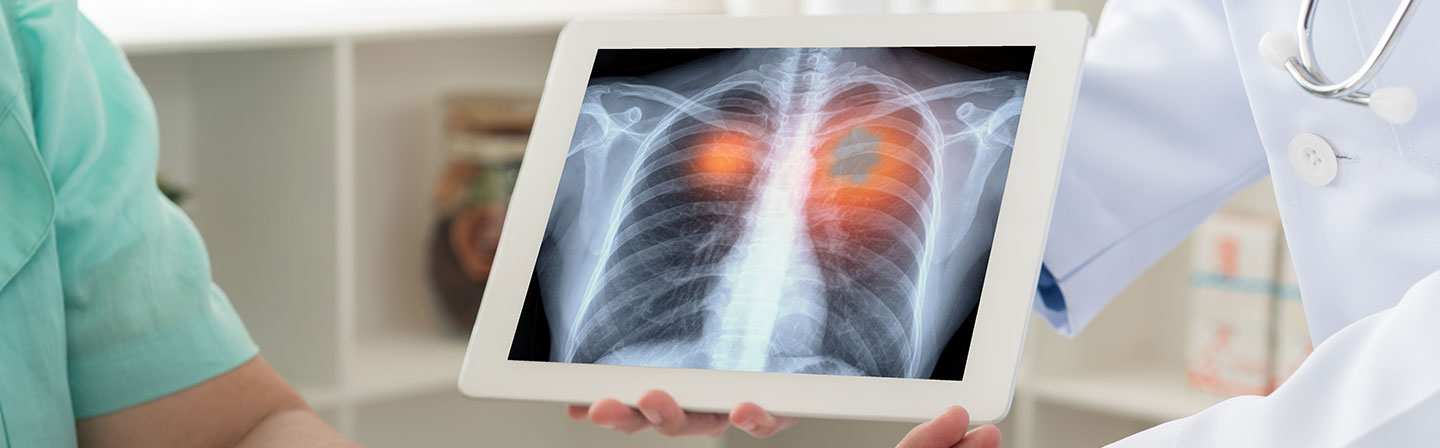

Cancer is one of the deadliest diseases that can destroy not only the individual but the entire family. Niva Bupa has listed down the top 10 cancer hospitals in Delhi, which include AIIMS, BLK super speciality hospital, Artemis hospital, etc. Know about some of the best cancer hospitals in Delhi.

READ MORE

Know about Pradhan Mantri Health Insurance for Senior Citizens under Ayushman Bharat and help your parents have a safe and secure future.

READ MORE

Here are the top 10 best hospitals in India. All these hospitals are known for their multi speciality program & teams of dedicated doctors and staff. Read to know about the best hospitals in India.

READ MORE

The human heart circulates blood throughout the body & is the primary organ of the circulatory system. Delhi has some of the best heart hospitals in the country. Get to know top cardiac hospitals in Delhi.

READ MORE

Read to have a deeper insight into the benefits of this program and explore the application process for obtaining the Golden Health Card.

READ MORE

Learn how to easily download your ABHA Card online for quick access to a world of healthcare and benefits. Get started today

READ MORE

Niva Bupa has provided a list of hospitals in delhi ncr that have gained a reputation for providing the best healthcare facilities. Read the article to get a deep insight.

READ MORE

Learn about the proof requirements for 80D medical expense claims. Ensure a hassle-free claims process with these insights

READ MORE

Easily check your PMJJBY policy status online. Stay informed and secure your financial future with this step-by-step guide.

READ MORE

Learn how to download your PMJJBY policy certificate step-by-step. Get your certificate hassle-free.

READ MORE

Discover the intriguing science behind sudden bursts of energy and its impact on your well-being. Explore how Niva Bupa sheds light on feeling energetic, excess energy, and the connection to anxiety.

READ MORE

Know about PM 12 Rs Insurance Scheme, its eligibilty, cost of enrolling, benefits,process of enrolling, advantages, how does the scheme works and what is not included in the scheme.

READ MORE_.jpg)

Ayushman Bharat Yojana scheme is a part of the national health policy of the Indian government. Read to know more about the benefits of Ayushman Bharat Yojana & Ayushman Card.

READ MORE

Health insurance portability is the right given to an insurance policy holder to transfer the credit gained by the insured (for no claim bonus, time bound exclusions and pre-existing conditions) if the insured member wishes to switch his/her insurer.

READ MORE

Know about dental care in health insurance, role of health insurance for dental care in overall health, dental procedures covered by health care insurance and options for dental coverage.

READ MORE

Know about Pradhan Mantri Health Insurance for a Healthy Life, its features, eligibility, benefits and ways to apply for health insurance.

READ MORE

Read to know about the top hospitals in Kolkata to help you choose the best hospital for your healthcare needs in the City of Joy.

READ MORE

To help people deal with their situation, many Coronavirus helpline numbers have been introduced to provide assistance to those in need. Read the article to know more about the important coronavirus helpline number.

READ MORE

Discover excellence in healthcare with our list of the top 10 hospitals in Chennai. Trustworthy, expert care for your well-being and peace of mind.

READ MORE

In this article, we will discuss some of the PMJJBY premium 436 plan details so that you can get the maximum benefits from it

READ MORE

Learn how to register and apply for the Karunya Health Insurance Scheme with this simple guide. Secure your healthcare today!

READ MORE

Pradhan Mantri Jan Arogya Yojana (PMJAY), known as Ayushman Bharat Yojana, is a scheme that aims to help the financially weaker sections of society. Read the article to know about PMJAY benefits and PMJAY coverage.

READ MORE

Learn how to easily register online for the MJPJAY Scheme. Access affordable healthcare with simplified registration steps.

READ MORE

The Insurance Regulatory and Development Authority of India (IRDAI) has recently updated its list of exclusions, or the conditions, which won't be covered by a regular health insurance plan. Read the article to know more.

READ MORE

This blog will provide you with a list of the 10 best ENT hospitals in India. If you are wondering which ENT hospital to go to, this guide is gonna save your time.

READ MORE

Know the top 7 Govt Health Insurance Schemes in India for example- Rashtriya Swasthya Bima Yojana (RSBY), Aam Aadmi Bima Yojana (AABY), etc

READ MORE

Learn how to apply or register on ABHA digital health card identification and know the process of downloading and deactivating on ABHA and what documents are required for registration.

READ MORE

A Health card is an insurance card that ensures that you get monetary benefits whenever there is a requirement. Without having a valid digital health card, it could become impossible to provide the right kind of medical assistance. Read to know about the importance of health card & the benefits of health card

READ MORE

When it comes to heart-related medical procedures, it is essential to look for the best heart hospital in India. In the article, Niva Bupa has mentioned some of the top heart hospitals in India so that you are in good hands.

READ MORE

Discover the top 5 Best Cancer Hospitals in Ahmedabad, Gujarat with Niva Bupa and know their best features to have a safe future.

READ MORE

Insurers have developed parameters to compare health insurance plans & one such parameter is known as the Health Insurance Claim Settlement Ratio or simply Claim Ratio. Read to know more.

READ MORE

Mediclaim policy is that covers an individual’s medical needs and costs, including but not limited to hospitalization, pre and post hospitalization charges.

READ MORE

Locating the best hospital in your area is a time taking task. Niva Bupa has listed the top 10 hospitals in bangalore. Read the article to know more about it.

READ MORE

When it comes to heart problems, having a list of atleast top 5 heart hospitals in kolkata is a boon . Niva Bupa has curated a list of top heart hospitals in Kolkata, known for their cutting-edge technology, and infrastructure. Read more.

READ MORE

Know how to reduce creatinine level, what are the normal levels of creatinine and what does high creatinine level do.

READ MORE

Know about Insurance Commission Income Tax, Taxable Income for Insurance Agents and TDS provisions.

READ MORE

Do you know what a health insurance premium calculator is? Read the article to know everything about Health Insurance Premium Calculator. This article explains definition, working & benefits of Health Insurance Premium & its Calculation

READ MORE

Explore waiting periods in health insurance plan, Learn how they affect coverage. Make informed choices for your healthcare. Get the facts today!

READ MORE

Read this article to know what is a Claim Settlement Ratio in Health Insurance Plans, how to calculate it and why it is important while buying a Health Insurance Policy in India.

READ MORE

Discover the significance of the wellness benefit in health insurance with Niva Bupa. Learn how this unique feature promotes preventive healthcare and rewards policyholders for leading a healthy lifestyle.

READ MORE

Know the process of filing a claim for health insurance and mediclaim and know the claim settlement process.

READ MORE

OPD treatments are those that do not necessitate admission to a hospital. Everyone should opt for a health insurance plan with OPD coverage. Know about the benefits of health insurance with OPD cover in India.

READ MORE

Don’t mix health insurance with critical illness insurance, as both policies are different from one another. Read the article to know more about the difference between health insurance & critical illness insurance.

READ MORE

Find out what is section 80D medical expenditure for senior citizens, its benefits, eligibility and what is section 80D.

READ MORE

Compare OPD Policies: Find the Best Health Insurance Plan with Niva Bupa. Make the Right Choice for Your Health Needs Today!

READ MORE

The Niva Bupa claim form is a crucial document that allows policyholders to file for reimbursement of their medical expenses

READ MORE

Have a knowledge about Pre-Existing Conditions by Health Insurance, coverage of pre-existing conditions by healthcare insurance in India and its benefits.

READ MORE

Know How to Check if a Hospital is Empanelled with the Insurer for Cashless Claims and the documents required to file claims.

READ MORE

Do let cancer be a hurdle in your life, contact the best hospital in India to get rid of it. In this article Niva Bupa has mentioned the top 10 cancer hospitals in India. Read the article to know more.

READ MORE

Explore the key points related to ABHA, including its step-by-step process for registration, why it is important and documents Required to Get the ABHA Card.

READ MORE

Discover Lucknow's leading healthcare centers. Explore the top 10 best hospitals in the city and prioritize your family's health and well-being.

READ MORE

Know about CM Insurance Scheme, its eligibility and features. Know how to enroll in CM Insurance Scheme and secure your family’s future.

READ MORE

The insurer offers the option of cashless claims or a reimbursement claim as a benefit. In the article, Niva Bupa has explained the tips to file reimbursement claims.

READ MORE

Read to have a deep knowledge of the top heart hospitals in Ahmedabad, their features and facilities they provide.

READ MORE

There are many benefits of Tulsi leaves. Top 10 health benefits of tulsi leaves are mentioned in this article. Read the article to know more about it.

READ MORE

Know about health coverage with a premium insurance solution need of the hour and how to upgrade your health coverage. Remember not all premium insurance solutions are the same.

READ MORE

Chief Minister’s Comprehensive Health Insurance Scheme was launched in Tamil Nadu by the Government of Tamil Nadu. The eligible people under the scheme can avail of cashless treatment at impanelled hospitals.

READ MORE

Don't let any desease be a cause of your life. Here is a list best hospital in chennai. Read the article to know more.

READ MORE

Gone are the days when quality healthcare was affordable in India. Know why you should care about rising hospitalizations costs in India. Read more.

READ MORE

Niva Bupa offers benefits of health insurance policy for you and your family. Health insurance benefits can be your perfect companion during a medical emergency. Know more.

READ MORE

Understand the impact of alcohol on health insurance premiums with Niva Bupa. Discover how excessive alcohol consumption can affect your health and potentially increase your insurance premiums.

READ MORE

Explore the top 10 multispeciality hospitals in Coimbatore, offering a wide range of medical services and advanced healthcare expertise

READ MORE

Read the Tips for Choosing the Right Kidney Stone Insurance Policy for Your Needs and understand its symptoms and diagnosis.

READ MORE

Niva Bupa Top-Up Plan is the ultimate solution for enhancing your health insurance coverage and protecting yourself from unexpected medical expenses

READ MORE

During medical emergencies, family health insurance for couples comes to the rescue. Family health insurance has a significant impact on the life of a newlywed couple. In the article, Niva Bupa has listed the top 10 reasons why a couple's health insurance is a must for newlyweds.

READ MORE

Best liver hospitals in Delhi provide cutting-edge treatments for various kinds of liver ailments. If you are looking for liver treatment, checkout our list and select a liver hospital in Delhi. Go through the article to know more.

READ MORE

Learn about dental coverage in health insurance. Understand if your policy includes dental care for a comprehensive approach to health.

READ MORE

People get confused between the benefits offered by individual & family health insurance plans. Know about the difference between individual health insurance & family health insurance.

READ MORE

Finding a hospital in your area is a difficult task. Some of the best hospitals in Kolkata have a team of talented professionals & nursing staff and use cutting-edge technology. Get to know more about multi-speciality hospitals in Kolkata.

READ MORE

It is difficult to identify the best hospitals with advanced technology & committed staff. Multispecialty hospitals in Hyderabad are the best in terms of reputation and price. Read & get to know about the top hospitals in Hyderabad.

READ MORE

To know what occurs with health insurance when the policyholder passes away. Learn about the process and implications

READ MORE

How to Age Backwards - Regular exercise can cause the skins aging process to reverse, even if one starts exercising later in life. Healthier lifestyle can help us age backwards.

READ MORE

Any disorder in the liver can create a significant problem in digestion & other metabolic processes. In the article, Niva Bupa has compiled a list of the best liver hospitals in India and their specialties to combat liver issues. Read more.

READ MORE

Have a knowledge of the Common Reasons for Health Insurance Claims Getting Rejected and How to Avoid Them.

READ MORE

Personal Accident Insurance is an insurance policy that can protect you from the financial repercussions & burden associated with accidental death or disability. Read to know more.

READ MORE

Have a deep knowledge on the impact of Ayushman Bharat Yojana on Rural Healthcare and development and its components.

READ MORE

Buying a health insurance policy is not easy. Read the article to know about the parameters associated with the health insurance policies that you should consider while buying it online.

READ MORE

Cancer Insurance Plan: Cancer takes a toll on one's health & finances. To reduce the financial stress, it is imperative to have a cancer insurance plan. Read to know more.

READ MORE

Ayushman Bharat Yojana is a flagship scheme and an initiative launched by the Indian Government to achieve the goal of Universal Health Coverage. Read to know more.

READ MORE

In this article, we will discuss some of the top hospitals in Pune, exploring their commitment to the health and well-being of the city's residents.

READ MORE

Niva Bupa provides health insurance for low income individuals or below the poverty line. Explore affordable and comprehensive health coverage tailored to meet the needs of those facing financial constraints

READ MORE

Commercial Health Insurance: Health insurance provided by a private & nongovernmental entity. Commercial health insurance policies are sold by for-profit private and public carriers.

READ MORE

Group medical insurance policy provides coverage to a group like society members, employees, etc. Understand how group plan is different from family/individual health insurance.

READ MORE

Explore the top 10 heart hospitals in Jaipur. Find expert cardiac care for a healthy heart in the Pink City

READ MORE

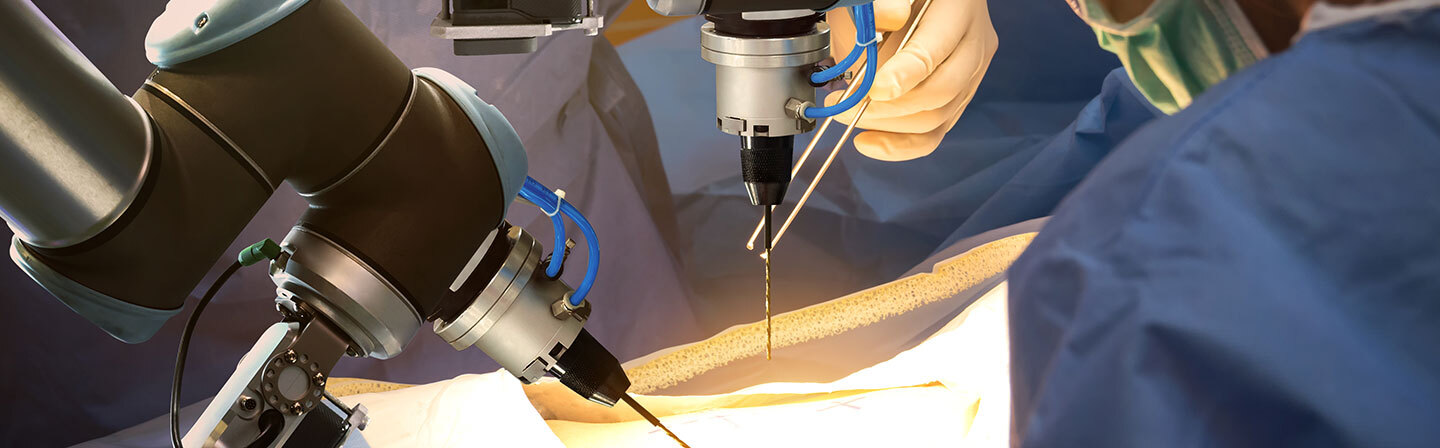

A robotic surgical system to perform surgeries on patients is known as robotic surgery. Get to know about robotic surgery, the benefits of robotic surgery, why perform robotic surgery, etc.

READ MORE

Cashless hospitalization is an important factor while buying a health insurance policy. It helps the insured person to get paid for the health treatment expenses directly by the insurance company.

READ MORE

Health insurance awareness is a significant problem. Despite the number of health insurance benefits, several factors are responsible for health insurance awareness problems. In the article, Niva Bupa has listed some of the health insurance awareness problems.

READ MORE

Discover the top 10 heart specialist hospitals in Chennai. Find expert care for your heart health in the heart of the city

READ MORE

Read the article by Niva Bupa to know about the round reality related to healthcare & health insurance in a non-metro city.

READ MORE

Explore the possibilities of extending your medical insurance coverage internationally with Niva Bupa. Unlock the potential of global healthcare protection with Niva Bupa today.ance is a must if you are travelling abroad. Read the article to know what Overseas Mediclaim Insurance is and what all is covered in this Health Insurance Plan.

READ MORE

Know the key differences between Term Insurance and Health Insurance Plans in India. It will help you choosing the right plan for your secure future. Read the article to know more.

READ MORE

Be prepared for potential 2023 health insurance premium increases. Stay informed about your coverage and financial planning.

READ MORE

/content/dam/nivabupa/Image/Livewell/free-look-period-benefits.png

READ MORE

The Cooling-Off Period in Health Insurance refers to the time you might take to heal after contracting a sickness. Know about the purpose of the Cooling-Off Period, how does Cooling-Off Period operate, etc. Understand the difference between the Cooling-Off Period in Health Insurance & Waiting Period.

READ MORE

Morning walks can revolutionize not only your morning routine but your life. Here are a few benefits of morning walk. Read to know more about advantages of walking in morning

READ MORE

Read to understand what maternity health insurance is and how to claim maternity insurance.

READ MORE

Discover the Government Cancer Hospital in Lucknow, providing vital cancer care services to the community.

READ MORE

Know how technology is changing the medical insurance industry, Future of insurance companies with technological advancements, analytics prediction and implications of technological advancements for consumers.

READ MORE

Find out Types of Health Insurance Policies that Require Third-Party Administrator Services, Role of TPA, how does TPA works and its types.

READ MORE

Find out the age limit for PMSBY and secure your financial future. Learn more about eligibility in this simple guide

READ MORE

Exploring options for adding parents to your health insurance and the benefits it provides. Make informed decisions for comprehensive coverage.

READ MORE

Locating the best hospital in your area is a time taking task. Niva Bupa has mentioned a comprehensive list of some of the best hospitals in Chandigarh, along with reputed clinics, where people can get the best medical treatment. Know more.

READ MORE_.jpg)

Ayushman Bharat Health Account (ABHA Card) is a digital card that provides all the information about your tests, past medical treatments, health insurance policy, etc. ABHA card provides Indian citizens with a digital ID which has a 14-digit identification number.

READ MORE

Cancer is a life-threatening disease that has no cure yet. Top cancer hospitals in India are well-equipped with the technologies that are required to treat any type of cancer. Read to know more about best cancer hospitals in India.

READ MORE

Save your GYM fee and workout at home - Niva Bupa suggest you to engage in a regular exercise regime indoors, to be happy both mentally and physically. Consult your doctor before exercise regime.

READ MORE

Your body needs to be in perfect balance in order to function effectively, for which you need to detoxify our body. Know about the tips on how to detoxify & cleanse your body.

READ MORE

Discover the Benefits of Preventive Health Check-Up Under Section 80D - A Wise Choice for Your Health and Finances.

READ MORE

Health insurance portability allows you to choose a different insurer without losing out on the benefits. Know all about health insurance portability.

READ MORE

A multi speciality hospital offers specialized treatments & medical facilities in one place. Check out the features, and new-age technology of multi speciality hospitals to pick the best multi speciality hospital in Mumbai. Know more.

READ MORE

Know the difference between immunisation and vaccination and benefits of immunisation and vaccination.

READ MORE

The insurance company will determine the premium you will pay on your Health Insurance policy depending on your age and income. This is a small part of how health insurance plans works in India. Do read the entire article to get a deep insight.

READ MORE

There are a lot of health insurance plans available in India. Niva Bupa offers best different types of health insurance policies in India to choose from. Know more.

READ MORE

If you want to secure future for all members, a family health insurance plan is an excellent investment. Read the article & know about the benefits of family health insurance plan.

READ MORE

Multi speciality hospitals in Chennai are known for their state-of-the-art technology, working staff, infrastructure, etc. Read the article if you are looking for the best multi speciality hospitals in Chennai. Know more.

READ MORE

Have a deep insight of the importance of provider networks in health insurance company, what are provider networks , its needs and Niva Bupa provider network.

READ MORE

Know about the right child health insurance plan, its types and how to find the affordable health insurance plans for child to secure its future.

READ MORE

Catastrophic Health Insurance is a health insurance policy designed to offer coverage for major medical expenses, preventive care, etc. You can get catastrophic health insurance from the Health Insurance Exchange. Know about the features of the plan & who should buy a Catastrophic Health Insurance Plan in India

READ MORE

Buying your first health insurance plan is not easy. Here are the 9 questions you should ask if you are buying first health insurance. Know more.

READ MORE

Covid after-effects might be here to stay. OPD centres have longer queues & OPD expenses can be costly. OPD cover in Health Insurance will save you from high expenses & OPD cover in Health Insurance helps you pay for pharmacy & consultations. Know about the importance of OPD in Health Insurance post-Covid-19

READ MORE

Before opting for health insurance or life insurance plan, always conduct adequate research and possibly even contact a financial planner to discuss all your options. Know more.

READ MORE

Daily activity like walking reduces your risk of a heart attack/stroke, and improves your overall heart health. Know more about on how to maintain a healthy heart for all ages.

READ MORE

In India, a 5 lakh health insurance plan is one of the most popular health insurance policies among individuals, families, and senior citizens.

READ MORE

Health insurance is a type of insurance that provides coverage for medical expenses. It can help to protect you from financial ruin in the event of a medical emergency.

READ MORE

Explore the differences between Mediclaim and Health Insurance to make informed decisions about your coverage. Learn about the features, benefits, and nuances of each option for better financial protection and healthcare support.

READ MORE

The out-of-pocket maximum in health insurance is the maximum amount of money you have to pay for the medical services you are covered under in a year. Get to know about Out-of-pocket maximum, and how Out-of-pocket maximum works.

READ MORE

A multi speciality hospital offers medical facilities & specialized treatments in one place. Check out the state-of-the- art technologies, well-built infrastructure of multi speciality hospitals to pick the best multi speciality hospital in Hyderabad. Know more.

READ MORE

A comprehensive health insurance plan offers complete financial protection against different types of health expenses. Get to know about the features of a comprehensive health insurance policy, how to buy a comprehensive medical insurance plan, etc.

READ MORE

To stay physically fit, you need to schedule a workout at home. Read the article & know about the 5 home exercises that will help you stay physically fit.

READ MORE

Diabetes can be reduced by having a control on the diet. There are specific diets for diabetic patients. Read to know more about the diabetic meal.

READ MORE

Buying a health insurance policy is not an easy task. Read the article & get to know about the different pointers that should be considered while buying a health insurance policy in India.

READ MORE

Whether you are self-employed or work for a large company, health insurance is a vital part of staying healthy and protecting your financial security. Read the article to understand the different benefits of having a health insurance plan.

READ MORE

Cashless Mediclaim Policy: Cashless Mediclaim Insurance is an excellent method to safeguard yourself against increasing medical costs without having to make any out-of-pocket payments. Know about types of Cashless Mediclaim Policy, and the need for Cashless Mediclaim Insurance.

READ MORE

Explore about the deductions allowed under section 80D, Deductions for Medical Insurance Premium and Deductions for Health Insurance Premium Payments for Senior Citizens.

READ MORE

It is very important to keep the body fit & work efficiently while maintaining rules of social distancing. Here's how you can work effectively & practice social distancing during lockdown.

READ MORE

Walking plays an important role in health & body fitness. Walk for Health is Niva Bupa’s commitment to helping Indian’s live healthier and more successful lives. Read to know more.

READ MORE

COVID-19 Survivor Stories: Dr Aarushi Gupta shares her story of battle with the Coronavirus and victory along with her take-way of strength inside out.

READ MORE

Check out the glossary of health insurance terms and understand the meaning of each health insurance term. Read to know more.

READ MORE

Every year, National No Smoking Day is held on the second Wednesday of March. This year it will be on 9th March 2022. Know about the reason behind No Smoking Day, the ill effects of smoking, why smokers should buy health insurance, etc.

READ MORE

There are several parameters on which we can differentiate between Cashless and Reimbursement Claim in Health Insurance, read to have a deep knowledge.

READ MORE

A group insurance plan offers a health insurance cover to a specified group of people like a co-operative society, employees of an organization, etc. Know more.

READ MORE

Discover the top 10 multispeciality hospitals in Bangalore, offering a wide range of medical services and advanced healthcare expertise.

READ MORE

Cancer occurs when the cells divide uncontrollably, leading to the formation of tumours & hampering the normal functioning of that organ. Read to know all about lung cancer, types of lung cancer, causes of lung cancer, lung cancer treatment, symptoms of lung cancer, etc.

READ MORE

Explore the factors that contribute to the cost of angioplasty in India and provides you with the information you need to make an informed decision about your healthcare options.

READ MORE

Housewives must take care of their well-being as their bodies undergo physical changes with age. The article explains different workouts for women to stay fit. Know more.

READ MORE

India has shown a good Covid-19 recovery rate which is mainly due to healthy eating. Know about the foods that coronavirus patients should eat for a quick & healthy recovery.

READ MORE

Health insurance needs in India are rapidly changing in line with the dynamic needs of the people. Read the article & know 5 things that your health insurance could cover.

READ MORE

Super speciality hospitals offer high quality patient care & indulges in exclusive care & treatment of a particular medical illness. Get to know about features, specialization, etc. of the best super speciality hospitals in delhi.

READ MORE

Open-Heart Surgery is a common procedure for heart surgeries. Open-Heart Surgery is done for two reasons, coronary artery bypass graft surgery or valve repair surgery. Read the article to know about the risks associated with Open-Heart Surgery, procedure & preparation of Open-Heart Surgery, etc.

READ MORE

Prioritise your health with annual checkups. Detect potential issues early, ensuring timely preventive care for a healthier future. Guard your well-being.

READ MORE

Flat feet is a condition where a personal's foot has no or a very low arch. Read the article by Niva Bupa to understand all about flat feet, like its symptoms, causes & treatment options.

READ MORE

Let’s look at its benefits of PMJJBY (Pradhan Mantri Jeevan Jyoti Bima Yojana), Learn about its features and enrollment process.

READ MORE

Underproduction and overproduction of thyroid hormone cause various symptoms of the disease called thyroid gland disorder. Around forty-two million people in India are diagnosed with thyroid gland disorders. Know about thyroid gland disorder, symptoms & treatment of thyroid gland disorder

READ MORE

Know the ultimate guide to find the heart patient health insurance plans and policy by Niva Bupa.

READ MORE

Oral Rehydration Solution (ORS): Every year, world ORS Day is celebrated on July 29, 2023, to remember the victory over critical illnesses like cholera and diarrhoea. Know more about World ORS Day, importance of World ORS Day, side effects of ORS, etc.

READ MORE

Before buying a health insurance policy, here are some common health insurance regulations that every policyholder should be aware of. Read to know more.

READ MORE

Diabetes is something that you can get at any age. In the article, Niva Bupa has explained 8 food products that can help you in keeping your diabetes in check & stay healthy.

READ MORE

Covid-19 pandemic has led to some sudden and drastic changes in workplace trends. Read the article to know the top 10 workplace trends you should follow after lockdown.

READ MORE

World Malaria Day 2022 is celebrated on April 15th to emphasize the need to take responsibility for ending malaria. Niva Bupa has explained all about malaria disease & the important facts about malaria. Read to know more.

READ MORE

Power walking helps you burn as many calories as jogging & you are less prone to injury. Niva Bupa has explained the tips to improve your power walking technique. Know more.

READ MORE

Constipation is a widespread problem in India. Food habits, medicines, etc. are a few causes of constipation. Get to know about quick & effective home remedies for treating constipation. Read the article & know about instant home remedies for constipation relief at home

READ MORE

The most common cause of this fear is a previous negative and unpleasant occurrence that’s associated with water.

READ MORE

Don't confuse cancer insurance with a critical illness plan. In the article, Niva Bupa has explained the difference between cancer insurance & critical illness plans. Read more.

READ MORE

The most ignored aspect of smoking has to do with our financial health. Read the article to know all about the impact of smoking on health & your wealth.

READ MORE

H3N2 virus, also known as Influenza A virus subtype H3N2, is a highly contagious respiratory illness that can cause a range of symptoms like flu and can include fever, cough, sore throat, body aches, fatigue, and headaches.

READ MORE

Essential travel in times of a coronavirus, is unavoidable. In such circumstances, follow these tips to protect yourself from coronavirus while travelling anywhere.

READ MORE

Know what is covered under Section 80D, its eligibility criteria, limits and documents required to claim deductions under section 80D.

READ MORE

Healthy Walking Tips and Benefits - There are many benefits of walking such as it strengthens the heart, helps fight stress and lose weight. Read the article to know more.

READ MORE

Know about the health insurance terms that truly matter and every policyholder needs to watch out for. Read the article for more information.

READ MORE

It is important for women to buy Health Insurance Policy in India. Understand the top benefits of Women's Health Insurance & how it has become an essential requirement in recent times.

READ MOREWant to try intermittent fasting? Here's the beginner's guide to intermittent fasting, as it is considered to be one the fastest way to lose weight and improve overall health.

READ MORE

Cavities can be avoided with measures taken at the right time. Lifestyle choices, flossing & brushing your teeth twice a day might help you get rid of cavities. Read the article to know more.

READ MORE

Taking care of family is a major concern for many people. Read the article & take care of your family with the best health insurance plan. Know more.

READ MORE

Eating right is not easy, especially if we look at our stressful lifestyle. In the article, Niva Bupa has explained how to live a good & healthy life with the right food.

READ MORE

Smiles can add more miles to your life - Here are 5 reasons why smiling every day is the best medicine for you! Read the article for more information.

READ MORE

Choosing the best hospital in India is a challenge. No need to go through researching & comparing Indian hospitals, Niva Bupa has listed some of the top hospitals in India. Read to know more.

READ MORE

Grace period is the extended period after the due date to pay your premium so you can renew your policy to file claims in case of a medical emergency. Know the Difference between grace period and waiting period.

READ MORE

Choosing the right health insurance plan is not easy. Niva Bupa can help you in choosing the right health insurance policy in India based on your requirements.

READ MORE

Arthritis refers to inflammation of the joints, which results in pain and stiffness. Advanced techniques such as joint replacement surgery is now a possibility. Know more.

READ MORE

Know what are the 5 best advantages of turmeric milk and the recipe of turmeric milk.

READ MORE

Know about protecting your loved ones with the PM 330 Rs Insurance Scheme, its features, benefirs, achievements and Claim Settlement Process under the PM Insurance Scheme.

READ MORE

The generally acknowledged first step towards mental #selfcare is to understand that we need time and focus when taking care of our mental well-being. Read to know more.

READ MORE

Go for a Group Health Insurance Plan if you want to buy health Insurance for a group of people. Read the article to know about the types of Group Health Insurance Policies available in India.

READ MORE

Just imagine the figure of other accidental deaths or injuries, which happen every day. That itself should be a major reason why should always be prepared with an accident insurance care plan.

READ MORE

Explore the contrasts between health insurance and medical insurance. Understand coverage nuances for informed decisions. Get clarity now!

READ MORE

Every year, international epilepsy day is celebrated on the 14th of February to raise awareness about epilepsy disease. National Epilepsy Awareness Month is observed in the US during November to raise awareness of epilepsy. Know about epilepsy, history of epilepsy disease, epilepsy treatment, etc

READ MORE

Read this article to know about Senior Citizen Mediclaim policies, and ways to ensure that you are choosing the best Health Insurance Policy for your Parents or Senior Citizens.

READ MORE

Breast cancer is one of the top causes of cancer death in women. The most frequent invasive malignancy in women is breast cancer. Know about causes of breast cancer, types of breast cancer, breast cancer treatment, etc.

READ MORE

Obesity is injurious to your health and wealth too. Get health advice and diet tips from health coach to reach your fitness goals and stay motivated 24X7. Know more.

READ MORE

Almost everyone is fed-up with mosquitos. Not to worry anymore. Read the article & know how you can banish mosquitos in 2 simple steps.

READ MORE

There are many benefits for investing in a critical illness cover which acts as a cancer insurance for you and your family. Let us take a look at some reasons to buy a cancer insurance plan.

READ MORE

Thanks to all the experienced parents, there is no lack of tips and tricks to raising your kids to be healthy. Here's a few tips of raising a healthy child in 2022

READ MORE

Recent studies have reported that 20%-30% of people in India suffer from allergic rhinitis and that 15% develop asthma. Read the article & know if allergies & health insurance go hand in hand.

READ MORE

Read to know about Frequently Asked Questions Related to the Income Tax Health Insurance Deduction.

READ MORE

It is better to compare different health insurance policies before finalizing a health insurance plan. Read the article by Niva Bupa & understand the importance of comparing health insurance.

READ MORE

Accident is an unfortunate incident that happens unintentionally, resulting in damage or injury. With a personal accident insurance, safeguard you and your family against accidents.

READ MORE

A personal accident insurance plan insures you against the financial burden & medical costs associated with an accident. Know about the reasons of buying accident insurance plan.

READ MORE

Discover the top 5 heart specialist hospitals in Patna, providing expert cardiac care for a healthier heart and life

READ MORE

If you are not getting the required amount of vitamin D from your diet, then also you can suffer from a deficiency of Vitamin D. Understand the ways to cure Vitamin D deficiency, symptoms of Vitamin D deficiency, causes of Vitamin D deficiency, etc.

READ MORE

Fitness enthusiasts now have started giving importance to mental endurance in addition to physical fitness. Read the article and understand how meditation & hiit work together.

READ MORE

Read to know the different insurers based on Claim Settlement ratio It will explore how to interpret the claim settlement ratio of health insurance companies.

READ MORE

The sooner you buy health insurance, the better. One way of protecting yourself is to opt for a health insurance at a young age. Visit Niva Bupa site for more information.

READ MORE

Pregnancy is not just the birth of a child, it’s the birth of a mother too. Here’s how to make this journey exciting and stress-free with the ultimate pregnancy survival guide.

READ MORE

Do you know why Claim Settlement Ratio is important for buying Health Insurance Plans? Niva Bupa explains why It is important for buying Health Insurance Plans. Read the article for Furter details.

READ MORE

For Buying Healthy Insurance Policy, speak to your insurance adviser. Get Niva Bupa's health insurance plan, which offers you maximum health protection and coverage. Know more

READ MORE

HIIT: High Intensity Interval Training improves metabolism, burns fat & keeps your body fit. Read the article to know more about HIIT & what type of HIIT workouts you should do.

READ MORE

You should try to reduce sugar intake in your daily diet. In the article, Niva Bupa has explained 7 hacks to reduce refined sugar from your diet. Know more.

READ MORE

Comparing Health Insurance Plans isComparing Health Insurance Plans is not easy. Understand the benefits of Comparing Health Insurance Plans Online. Read this article to know more about it. not easy. Understand the benefits of Comparing Health Insurance Plans Online. Read this article to know more about it.

READ MORE

Now you can buy insurance coverage by paying an affordable premium with a 1 Lakh health insurance plan. It provides coverage of 1 lakh to the policyholder against any unfortunate event.

READ MORE

Glut of paper products mean excessive and abundant supply of paper in the market. Read the article by Niva Bupa to understand the glut of paper products and its effect on environment.

READ MORE

Explore the list of best hospitals in Noida, providing top-quality medical care and healthcare services to the community.

READ MORE

Diwali also brings pollution caused by crackers. Here are 6 fun-filled ways to celebrate Diwali without polluting the air. Read the article for more.

READ MORE

Nutrition plays a significant in controlling hypertension. Here is a quick list of foods to consume which help fight hypertension. Read to know more.

READ MORE

Know health insurance policies and its benefits also know how to choose the best health insurance plan in India?

READ MORE

Every year, April is observed as Parkinson's Awareness Month to increase awareness about the disease. Read to know about Parkinson’s Disease, Parkinson’s awareness month & the various symptoms of the disease.

READ MORE

Few tips to keep your house squeaky clean and super healthy all year round. For more tips to have a healthy house, read the article today.

READ MORE

There are 5 ways to go about finding the right doctor for you, as finding the right doctor for you is more important for your health/life. Read the article for more information.

READ MORE

Not just elder people, nowadays even kids are not safe from diabetes. Read the article to know about the different symptoms and the first signs of diabetes in children.

READ MORE

Read to have a deep knowledge about The Challenges and Opportunities of Implementing the Prime Minister's Insurance Scheme.

READ MORE

A Group Health Insurance Policy provides many benefits to both employees and the employer. Read this article to know about all the advantages of Group Health Insurance Policy in India.

READ MORE

Have a deep knowledge about medical insurance premium tax benefit, its eligibilty, advantages, How Can Medical Insurance Premiums Be Paid, conditions and limitations.

READ MORE

We must do whatever it takes to keep our immune system strong. Here are 5 ways to boost your immunity for longevity. Read the article for more information.

READ MORE

Hypertension can be controlled by making small lifestyle changes such as your diet, lifestyle. Here are 4 ways in which you can reduce hypertension with proper diet. Know more.

READ MORE

Caffeine helps with mental alertness, energy level & memory power. Liver health, and athletic strength, are a few benefits of caffeine. Along with benefits, weight loss, and headaches, are some of the side effects of caffeine. Read to know more.

READ MORE

Meditation is the ultimate exercise for the mind. While you meditate you'll realize how active your mind is throughout the day. Visit our website today for more information.

READ MORE

Tobacco kills, but not before presenting you with numerous grave health issues. Every year, World No Tobacco Day or Ant-Tobacco Day is celebrated on 31st May. In the article, Niva Bupa has listed a few health issues caused by tobacco. Read to know more

READ MORE

Health insurance is important for senior citizens as they are more prone to diseases & critical illnesses. The article explains the need of buying health insurance for senior citizens.

READ MORE

Find out why complete heart attack insurance is important to maintain your health ans security, its features, things covered under heart health insurance and best hospitals in Delhi.

READ MORE

Niva Bupa offers best family health insurance plan with benefits like cashless facility, includes cover for your spouse, children, and parents. Read for more information.

READ MORE

Picking a health insurance is based on the benefits associated with the policy. Read the article to know about the different tax benefits assured with health insurance plans in India.

READ MORE

Discover the benefits and functionality of a 5 lakh health insurance premium calculator. Empower yourself with informed coverage decisions.

READ MORE

Omicron, the latest covid-19 variant has been extremely infectious from the beginning of the spread of the disease. Know about the symptoms of the omicron variant, how omicron is different from other variants, treatment & preventive measures of omicron disease.

READ MORE

Know about the High-Value Health Insurance Plans, Checkout the features like coverage, Limits for Room Charges, amount of coverage for health insurance medical plan. Read Faqs for related family or individual health insurance plans.

READ MORE

It is difficult to select a particular health insurance policy. Read the article & know how to choose the best health insurance in India. Read for further details.

READ MORE

Know about how to take care of your heart health with cardiac insurance by understanding heart disease, living with heart disease and role of your health insurance.

READ MORE

The COVID virus has caused many deaths and risked the lives of numerous individuals. If you are eligible for the COVID vaccine, getting the vaccine dose right away is essential to protect yourself. Know more about the types of covid vaccines in India.

READ MORE

Read to know the Calculation of the Health Insurance Deduction and the Maximum Limit Allowed.

READ MORE

We start exercise with full enthusiasm but after a few months lose steam. Here are some things which you can do to add a little zing to your workout. Know more.

READ MORE

Learn the crucial meaning and significance of sum insured in health insurance plan. Protect your well-being wisely. Get started now!

READ MORE

Simple lifestyle changes can help prevent cancer. Healthy diet, timely vaccinations, regular medical screening, etc. are some of the tips to prevent cancer. Click here to read more.

READ MORE

Keeping fit during the festival Season - increase the fun not your weight. Some health tips help you to keep fit during festival season. For more fitness tips read the article.

READ MORE

Learning how to deal & manage stress is critical to lead a healthy life. Read this article & look at the different strategies to deal with stress today.

READ MORE

You should not always go for a cheaper health insurance plan. In the article, Niva Bupa has explained if a cheap health insurance policy is the right choice for you. Know more.

READ MORE

Invest in good medical insurance for major diseases, especially cancer. Read to know more.

READ MORE

Have an insight of the Common Mistakes to Avoid While Claiming the Health Insurance Deduction.

READ MORE

Below mentioned is the list of the best cancer hospital in Karnataka. So if you are looking for top-notch cancer care, this list is what you need.

READ MORE

Along with helping save lives, there are number of reasons why donating blood is important. Read the article to know about importance of blood donation & its process.

READ MORE

ENT usually used to treat chronic illnesses. Here are the major advanced treatments required for patients.

READ MORE

Waking up to Morning Sickness? Here are some of the symptoms that you need to watch out for during morning sickness. Read the article for more information.

READ MORE

Discover the requirements for obtaining group health insurance coverage and confirm that you satisfy them. We've compiled a useful resource to help you understand the insurance market, including enrollment deadlines and coverage alternatives.

READ MORE

Healthcare costs are rising & a health policy can prepare you for these medical emergencies. While buying a cashless mediclaim policy, be sure that it is enough to cover all the expenses. Know more.

READ MORE

Looking to binge in the wedding season? Just be careful of gerd, - read the article today for more information.

READ MORE

Losing Weight After 40 - Here are a few ways to understand the challenges that prevent weight loss after 40 and how to overcome them. Read the article to know more.

READ MORE

Aerobics is any form of physical exercise that is done at continuous intervals with varying intensity, which results in better respiratory and circulatory function of the body. Know more about Aerobics.

READ MORE

Pregnancy is not a hindrance to travel. You just need to stay cautious of a few things during the trip. Here are a few travel tips for women that will help them to make their trip easier. Read the article to know more.

READ MORE

What is Schizophrenia? Schizophrenia does not have a cure to date though various treatments can reduce the symptoms and allow the person to lead a normal life. Read the article for more information.

READ MORE

It is essential that we make it clear that a diabetic is not more vulnerable against the coronavirus. In the article & understand if coronavirus & diabetes are related.

READ MORE

People get a little confused while selecting personal accident insurance plan. In the article, Niva Bupa has explained 5 tips on how to buy personal accident insurance policy.

READ MORE

Improve your holistic health & take the #OneStepADay challenge wherein you just have to pick one activity to do, and keep up with it as the days go by. Know more.

READ MORE

Know how to take control of your health with Niva bupa individual insurance, its types, key features and what it covers.

READ MORE

Know about empowering Diabetics with comprehensive supplemental insurance, need of Supplemental Insurance for Diabetics and Why Choose Niva Bupa Insurance for Diabetic Patients.

READ MORE

Secure your well-being with Niva Bupa's Women Health Insurance. Tailored to meet the unique healthcare needs of women, our insurance plans offer comprehensive coverage and peace of mind. Explore our options for a healthier future.

READ MORE

Know what senior citizens health insurance and its benefits also know what you should look for before buying a senior citizen mediclaim policy?

READ MORE

While pandemics are unpredictable by nature, proper preparation and planning can help reduce the chances of contracting Covid-19 virus. In the articles, Niva Bupa has explained the 5 lessons learned from pandemic. Read to know more.

READ MORE

Happy mind helps you to stay healthy & live a happy life. Learn about the different ways in which you can rewire your mind for happiness & forget all the tensions around you. Read to know more.

READ MORE

There could be several reasons as to why you should consider buying a health insurance policy. Read the article & understand why you need a comprehensive medical insurance policy in India.

READ MORE

Read to understand the extent of coverage and benefits available for OCD through health insurance.

READ MORE

Cardiovascular Disease: The heart is a muscular organ located between the two lungs. Heart failure, heart attack, and stroke are some cardiovascular disease types. Get to know all about cardiovascular disease, symptoms of cardiovascular disease, and causes & prevention of cardiovascular disease

READ MORE

Read to have a deep knowledge of the steps for buying 1 crore healthcare insurance, which will give you assurance and financial security in case of a medical emergency.

READ MORE

With so many options to choose from, how do you go about picking the best cancer insurance plan in India? Here's how you can select the best cancer insurance plan in India.Read the article to know more.

READ MORE

Sinuses are the hollow spaces within the bones between your eyes, in your forehead & behind the cheekbones. In the article, Niva Bupa has explained all about Sinus, symptoms of Sinus, Sinus treatment, Sinus infection, home remedies for Sinus treatment, etc.

READ MORE

When you look at the options for yoga classes available, you would find Hatha, Vinyasa, etc. Brief description for the kind of yoga asanas is added on the page. Know more.

READ MORE

Does health insurance cover ambulance fees? It is one of the most frequently asked questions of policyholders.

READ MORE

Explore the Importance of Monitoring Heart Beat Rate and Its Impact on Overall Health, its types and impact of heart rate on overall health.

READ MORE

Niva Bupa Health Recharge is a healthcare solution that provides comprehensive coverage and peace of mind. Read to know more.

READ MORE

Travelling can be healthy for your mental well-being. Travel and mental health are closely connected. Travelling for mental health helps you relax, rejuvenate and recharge. Read the article & get to know about the reasons why travelling is good for mental health.

READ MORE

The burrito is loaded with egg whites and is a high protein breakfast which is low in carbs with no sugar. This recipe for diabetics has a delightful taste. Know more.

READ MORE

Discover the diffrence between PMSBY and PMJJBY schemes easily. Make informed decisions for your financial security.

READ MORE

Read to have a deep insight of the basics of dental healthcare insurance and what points to consider while buying one.

READ MORE

From the warm rush to the not-so-pleasant wine headache or the morning hangover, are a few side effects of drinking alcohol. In the article, Niva Bupa has listed a few harmful effects of alcohol on the human body.

READ MORE

Read to have knowledge about how a heart attack insurance policy can save you during medical emergencies.

READ MORE

Here is a list of mouth-watering recipes that make up a perfectly healthy meal. Read the article for more information.

READ MORE

After Covid-19 lockdown, safe workout at gym has become a prime concern for many of us. Read the article & know if it is safe to workout in gym after covid-19 lockdown.

READ MORE

What are some of the lifestyle habits that will stay when there isn't a pandemic going on? Read to know about important habits that you should stick to post lockdown.

READ MORE

Premium health insurance is a smart investment in your well-being and peace of mind. Niva Bupa offers a range of options tailored to fit your unique needs and budget.

READ MORE

Discover the best hospital in Kerala, providing exceptional medical care and advanced healthcare services.

READ MORE

All over the world, more than 2 billion cases of diarrhoea are reported every year, & approximately 2 million children below the age of 5 years succumb to this disease. Read the article to know all about diarrhoea, symptoms of diarrhoea, diagnosis & treatment of diarrhoea, etc.

READ MORE

Have a detailed knowledge of the benefits of having health insurance, Panacea for Health-related Worries and its financial and health security.

READ MORE

Know the secret to a stress free life with Niva Bups’s heart insurance, what is heart insurance, its benefits and which are the best hospitals in Hyderabad for heart ailments.

READ MORE

We are falling ill than ever before, thanks to our stressful lives. Protect your family & buy a health insurance policy today. Know more.

READ MORE

Under section 80D, you can claim a deduction on the premiums paid towards a medical policy for yourself, your spouse, dependent children, and your parents.

READ MORE

Indemnity insurance plans are becoming increasingly popular in an ever-changing healthcare insurance landscape.

READ MORE

Common health issues that women are facing and how better lifestyle, regular screening and medical check-ups can help in prevention, early detection and treatment.

READ MORE

Have a deep knowledge of tax benefits of different types of health plnas, its types and benefits.

READ MORE

Discover the main origins of health coverage. Explore the Three Primary Sources of Health Insurance and make informed decisions for your healthcare needs.

READ MORE

Know the benefits of Family Cancer Insurance, its need, benefits and types of cancer covered under the family cancer insurance.

READ MORE

Read to know the process of choosing the perfect dental health insurance plan that fits your budget and covers your dental needs.

READ MORE

Choose Best Family Health Insurance Plans in India. Buy Medical Health insurance plan for family, parents online and secure their future today. Know more.

READ MORE

Discover the significance of a standalone critical illness insurance policy for comprehensive household protection against severe medical conditions.

READ MORE

Explore the top cancer hospital in Bhopal, offering advanced care and hope for cancer patients and their families.

READ MORE

Know the types and benefits of mediclaim policy for family. Niva Bupa is providing information about mediclaim policy for family and sr. citizens and lots more.

READ MORE

Here's how you can make your own Sun-dried Tomato, Mushroom, and Spinach Quiche, which is Vegan, gluten-free, refined sugar-free and works perfectly on your stress! Read our article today!

READ MORE

Know the eligibility criteria for health insurance and mediclaim and factors that affect premiums and the difference between health insurance and mediclaim.

READ MORE

Get Knowledge about How the Prime Minister's Insurance Scheme is Revolutionising Healthcare in India, its need for healthcare reform in India & Transformation in PM’ insurance scheme.

READ MORE

Explore how a critical illness derail your finances, why is it important to opt critical illness health insurance and what are the factors to keep in mind before buying a plan.

READ MORE

At times, people get confused between corona kavach & health insurance. In the article, Niva Bupa has clearly explained the difference between the 2 insurance plans.

READ MORE

Buying Health Insurance for a woman is an important decision. These factors need to be considered before buying a Women Health Insurance Policy in India. Read more.

READ MORE

5 Indoor Exercises to Burn Fat - We bring you 5 simple indoor activities that can be done at home easily that will boost your stamina and keep you fit. Read the article to know more.

READ MORE

To take care of your heart, you not only need to exercise regularly but also eat right. But who says you have to say no to your favourite meals to keep your heart healthy? Know more.

READ MORE

We must familiarize ourselves with information about coronavirus and learn the different terms related to it. Read to know about the different coronavirus terms.

READ MORE

Know Importance of Researching Health Plans Before Purchasing and Factors to Consider Before Choosing a Plan

READ MORE

Read to know the PM insurance scheme and how to buy a PM insurance scheme for senior citizens.

READ MORE

Know The Impact of Healthcare Reform on Health Insurance Policies, expansion of coverage, cost and affordability in health care.

READ MORE

In the article, Max Bupa has explained the key differences between Health Insurance Plans and Personal Accident Insurance Policy which will help you in choosing the right plan.

READ MORE

Sugar - The Bitter Truth. Here's how sugar addiction can be a sour news for your health. Read the article for more detailed information.

READ MORE

Know a list of the top ten hospitals in Ahmedabad which have been recognised over the years for their superior patient-centric services.

READ MORE

Learn if dementia is covered by health insurance. Understand how health insurance can support you in facing this condition.

READ MORE

Tips to make the perfect DIY Caesar Salad dressing at home to add that extra flavour to your super nutritious salad. For more information, read the articles.

READ MORE

Research shows that exercise is important for controlling diabetes. Max Bupa explains why exercise is a must for people with diabetes. Click here to read more.

READ MORE

Children are the most vulnerable to pollution. Here are few simple ways to help protect your kids and help them breathe better. Read to know more.

READ MORE

Busy in those morning meetings, client calls & brainstorming sessions? Don't forget to workout along with working hard at your workplace. Read to know more.

READ MORE

The lockdown has had a direct impact on our finances in one way or another. Know about precautions related to coronavirus & how can you bank from home.

READ MORE

Discover excellence in cancer care at the best cancer hospital in Gwalior, offering advanced treatments and unwavering support

READ MORE

Learn how to access fast cashless medical care during emergencies. Understand the process and benefits for swift and hassle-free treatment.

READ MORE

Strawberry tofu ice cream for kids - Follow this simple recipe and give your kids a healthy surprise! Read the article for more information.

READ MORE

We all see coughing in children. When it gets frequent, that's when you need to consult a specialist. The article explains 5 ways to protect your child from Asthma.

READ MORE

Getting a COVID-19 health insurance coverage is a wise step to take during such times. Know about the considerations while buying insurance during covid-19.

READ MORE

A long day at work takes a toll on your body and mind. You can actually begin this process even before you reach home. Here are a few simple ways to rejuvenate on your way home.

READ MORE

Make no mistake, a health insurance is an absolute must in today's modern and urban living. Read the article & know how to get a health insurance plan.

READ MORE

Working out as a couple opens your doors to many new exercises and workout regimes. These various exercises and workouts can be beneficial for various parts of your mind, body and soul.

READ MORE

Many studies have associated the process of metabolism and ageing. Read the article by Niva Bupa to understand this connection and know how metabolism & ageing go hand in hand.

READ MORE

Bored of routine workout? Follow few tips to maximize the output of every workout session. Read the article today to know more.

READ MORE

Winters is the best season to lose weight. Your body needs physical exercise to heat up things and gets your blood pumping and circulating in your body. Read the article for more tips.

READ MORE

There are people who go into a shell and remain depressed for far too long. This elongated phase of negative emotions is known as clinical depression. Read to know more.

READ MORE

Explore the best hospital in Coimbatore, delivering top-quality medical care and healthcare services to the community.

READ MORE

Laugh your way to A healthy heart - Little do we know that enjoying a good laugh benefits our heart in ways more. Here are few benefits of laughter on our heart. Read more.

READ MORE

Copayment insurance is a type of healthcare insurance that requires the insured to pay a certain amount of money each time they receive healthcare services.

READ MORE

We should do everything in our power to improve our immunity and holistic health during this lockdown. Here are 6 ways you can boost your immunity from the comfort of your own home.

READ MORE

A group health insurance is designed to provide coverage to employees or employer. They have numerous benefits especially if you are employed with an organization. Here are a few of them.

READ MORE

There are many policies that are available in the market. So how do you go about choosing the best cashless health insurance policy for yourself? Read to know more.

READ MORE

Exercise plays a key role in building strong immunity, following a healthy diet. Plan a healthy diet & build your immunity post lockdown. Know more.

READ MORE

Explore disparities between family health insurance and floater plans. Learn which option suits your family's needs best for comprehensive coverage.

READ MORE

Discover the top 5 long-term health insurance policies for comprehensive coverage and peace of mind. Find the best plan for your needs today!

READ MORE

Do you know the future of Corporate Health Insurance, its trends and predictions? With Niva Bupa know the importance of corporate health insurance.

READ MORE

Secure yourself by buying the right insurance policy in India. Understand how buying the right medical insurance policy will help you in covering your medical costs today.

READ MORE

Learn about Preventive Health Checkup 80 Proof for proactive wellness. Take charge of your health today.

READ MORE1.jpg)

Consider these factors while buying health insurance policy in India. In this article, Niva Bupa has explained the things that you should look into while purchasing a health insurance plan.

READ MORE

Myths have spread around blood donation due to lack of awareness and facts. Let's look at the top 5 myths and debunk them, once & for all. Know more

READ MORE

You don't always need expensive gifts to express your love. Sometime just your gestures can do the trick. Here are simple ways to show how much your family mean to you:

READ MORE

Covid-19 has impacted greater population & it has been difficult for some to cope up. Know about the different steps to take if you are not able to make the ends meet. Read on.

READ MORE

Discover the advantages of comprehensive health insurance plans. Explore coverage benefits for enhanced financial security and peace of mind.

READ MORE

Know the benefits of Health Insurance Premiums, Different health insurance & tax impacts, Section 80 D deductions under health insurance schems and Lots more.

READ MORE

Read to discover the perfect insights on the benefits of high-deductible health plans for individuals. Learn more today

READ MORE

Explore the PMJJBY Scheme policy, its benefits, claim process, and more. Secure your financial future with this comprehensive guide.

READ MORE

Find the Best Cancer Hospital in Kolkata? Discover Top-Notch Care and Advanced Treatments for a Brighter Tomorrow.

READ MORE

Read to know the Top 5 reasons why you need an accident insurance plan and get your family insurance coverage today.

READ MORE

You need to protect your body against pollution to have a long & healthy life. Read this article to know how you can shield your body against pollution.

READ MORE

If you're curious about the policy premium, you can take advantage of a health insurance premium calculator, which helps you estimate the cost involved before making a purchase.

READ MORE

With the right health insurance plan, you can boost the health of your investment portfolio. Read the article to know more.

READ MORE

Read to know some of the best Raipur heart hospitals and the facilities they provide to patients.

READ MORE

There are numerous tips and suggestions on how to maintain a healthy and balanced life. To know more information, visit our articles section.

READ MORE

Explore the Factors Affecting Health Insurance Costs - A Comprehensive Guide to Informed Decision-Making

READ MORE

Explore the best hospitals in Pune, offering top-notch medical care and compassionate healthcare services to the community.

READ MORE

Stay ahead with our guide to the 7 crucial trends shaping group health insurance. Discover key insights and actionable strategies to optimize your coverage.

READ MORE

All you need to is login to the Niva Bupa app and set your goals & take better care of your Health. The health coach will then work with you & help you achieve these goals.

READ MORE

Compare health insurance plans in India for your family. Prioritize key features like coverage, premiums, network hospitals and claim settlement ratio. Read now

READ MORE

When looking for the best hospital for cancer in Nagpur, there are certain things people need to keep in mind.

READ MORE

It's a good thing that there are more of these cancer facilities in Guwahati since it means that more people will have access to high-quality cancer care. Read more.

READ MORE

Empower yourself with knowledge about health insurance policy. Understand your options and protect your health and finances. Start your journey to better coverage

READ MORE

Patna's expanding cancer hospitals underscore the city's commitment to enhancing healthcare accessibility and improving outcomes for cancer patients.

READ MORE

Explore the Difference between Section 80C and Section 80U for tax deductions. Make informed financial choices today

READ MORE

Discover the top cancer hospital in Surat, where expert care and cutting-edge treatments come together for comprehensive cancer management.

READ MORE

This article presents a comprehensive list of the best cancer hospitals in Jaipur, where patients can find hope, healing, and a chance at a better tomorrow.

READ MORE

It is important to buy health insurance with rising inflation and increasing healthcare prices. Health insurance covers the medical expenses of the insured. In the article, Niva Bupa has explained the reasons for buying mediclaim policy online in India.

READ MORE

Know about the top Baroda heart hospital, which offers modern and advanced medical services.

READ MORE

Have a detailed knowledge on caring for senior citizens, things to look out for while caring for senior citizens and their insurance scheme.

READ MORE

Have a deep insight about how to choose best medical insurance for senior citizens, read the tips before purchasing a senior citizen health insurance.

READ MORE

Discover the top heart hospital in Surat, providing advanced cardiac care for a healthier and stronger heart.

READ MORE

Buy travel insurance to protect yourself from overseas travel. Getting overseas travel insurance will protect you from cons & make your vacation worthwhile. In the article, Niva Bupa has explained different tips that will help you avoid travel scams for your next overseas travel.

READ MORE

5 Way to Speed Up Fat Loss - Take few steps to lose weight but you can definitely speed it up with changes to your lifestyle. To know more steps, read the article.

READ MORE